- Columns A through F – Enter the item number, item description, vendor name, date of the increase request, the vendor contact who requested the increase, and the date the increase will be effective.

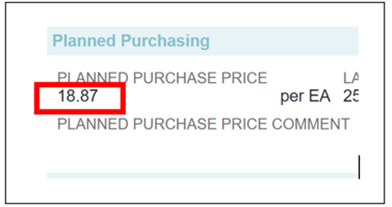

- Column G – Old Planned Purchase Price

- This is the price we were paying the vendor before the increase. If we had bracket pricing, enter the highest cost/lowest MOQ price.

- You can find this information under the Costing subtab.

- Column H – Freight

- Confirm that the carton dimensions are verified and that the freight method is correct in Netsuite. If either needs to be updated, do it now.

- Use the Planned Freight Cost once you have confirmed that the carton dims and freight method are accurate.

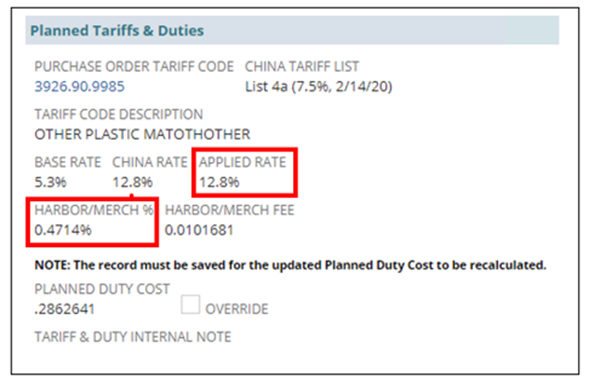

- Column I – Duty %

- Enter the current applied duty rate percentage listed in Netsuite unless your item has an exclusion of some sort.

- Remember to add .4714% to account for Harbor & Merch fees.

- Example: 12.8% duty + .4714% H&M = 13.2714%

- Column J – Old Planned Total Cost

- The spreadsheet’s formula adds the freight cost and duty percentage from columns H & I to the old planned purchase price in column G.

- Column K – Initial Requested New Planned Purchase Price

- This is the INITIAL cost increase provided by the vendor. Enter the highest cost/lowest MOQ price if they provided bracket pricing.

- All price increase requests must be negotiated with the vendor, so column I is listed as “initial requested.”

- Column L – New Planned Total Cost

- The formula will calculate the new planned total cost by adding the new planned purchase price, freight, and duty.

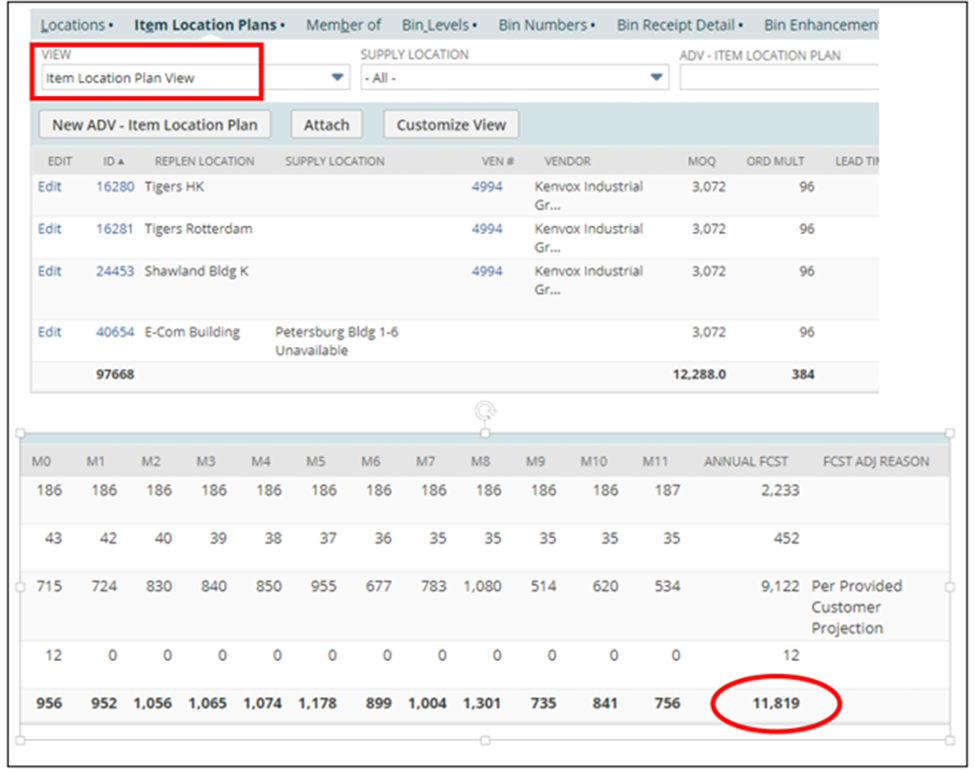

- Column M – Annual FC

- Under the Inventory Detail Subtab, go to the Item Location Plans Sublist.

- Change the View to “Item Location Plan View” to see the forecast for each location. The total forecast for all locations is in bold on the bottom right.

- Columns N through R (formulas will calculate automatically)

- Column N & O – Annual Purchases at Old & New Planned Total Cost: Calculates our expected annual costs based on the old and new planned total costs.

- *Note: These fields must represent our actual costs, including freight and duty, not only the planned purchase price from the factory. Please do not change the formulas to pull planned purchase prices.

- Column P – Initial % Increase Sought by Factory: This field shows the percent increase for the planned purchase price requested by the factory.

- Column Q – % Increase with Planned Total Cost: This field shows the percent increase for our planned total cost, including freight and duty.

- Column R – Final Annual Increase Effect: This field shows how much extra money we will pay based on the annual forecast.

- Column N & O – Annual Purchases at Old & New Planned Total Cost: Calculates our expected annual costs based on the old and new planned total costs.

- Column S – P&S Notes

- Add a brief summary explaining the increase and any relevant details from the factory.

- *Note: When you send the Price Increase Form for approval, attach any relevant email communications with the factory to show what P&S has already done to push back on the vendor.

- Add a brief summary explaining the increase and any relevant details from the factory.

- Column T – Negotiated Final Planned Purchase Price

- After pushing back on the vendor and receiving a lower price than the original increase from Column K, enter it here.

- If you were unsuccessful in negotiating a lower cost, enter the original increased cost from Column K here.

- Columns U, V, & W (formulas will calculate automatically)

- Formulas will calculate the negotiated final planned purchase price % increase, the revised new planned total cost, and the revised planned total cost increase %. If there was no change to the planned purchase price after negotiation, these columns should match Columns P, L, and Q, respectively.

- Columns X, Y, Z, & AA

- Fields filled by the Director of P&S.

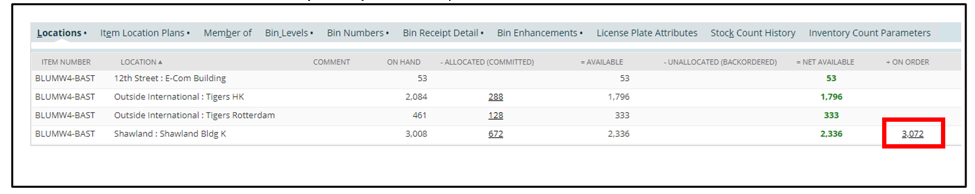

- Column AB – Item MOQ

- Enter the MOQ from the factory.

- Column AC – Open Order Qty

- Enter the quantity currently on an open order.

- If the item is not currently on open order, enter 0.

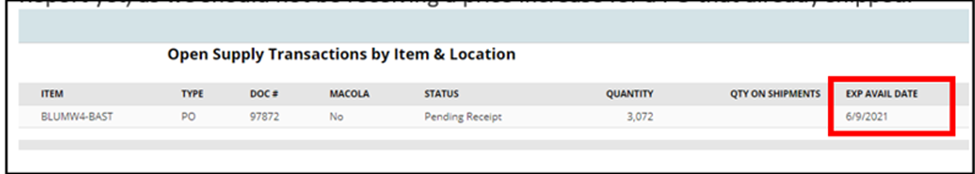

- Column AD – Expected Order Arrival Date

- Enter the date the inventory is expected to arrive in our warehouse.

- You can find this information on the PO. There is probably not an Inbound Shipment Report yet, as we should not receive a price increase for a PO that already shipped.

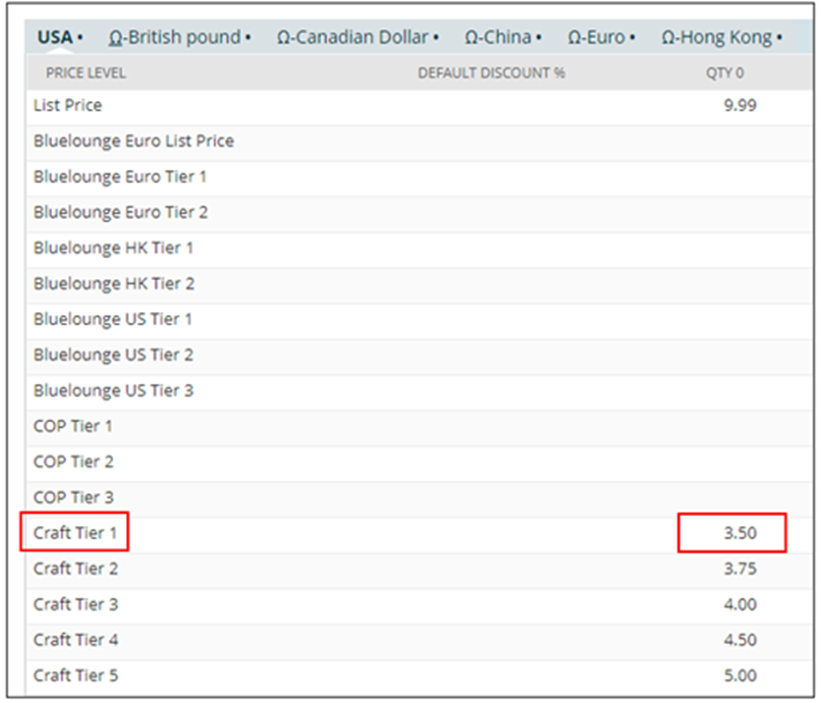

- Column AE – Current Tier 1 or Key Account Customer Price

- Go to the Pricing subtab and use pricing from the relevant Tier 1 pricing entry.

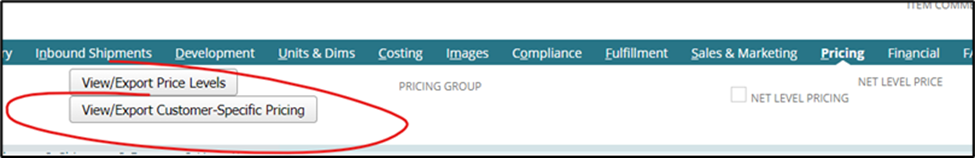

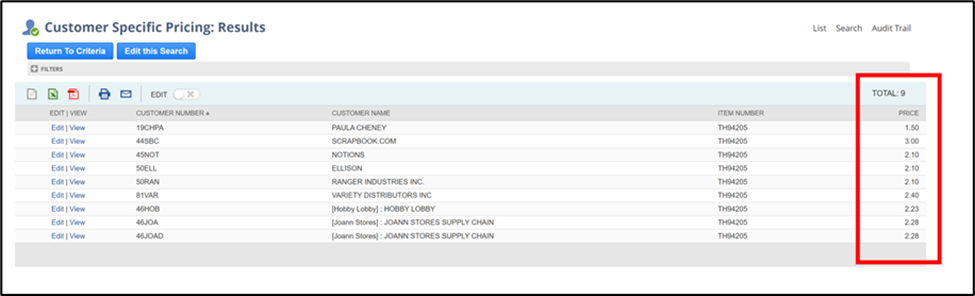

- If no price tiers are entered, the product might have customer-specific pricing. Use the View/Export Customer-Specific Pricing button to find it.

- Columns AF and AG – GM (Gross Margin) with Old/New Price

- Formulas will calculate gross margins based on the old and new planned total costs and the customer sell price in Column AD.

- *Note that the GM with the new price comes from the renegotiated price in Column W.