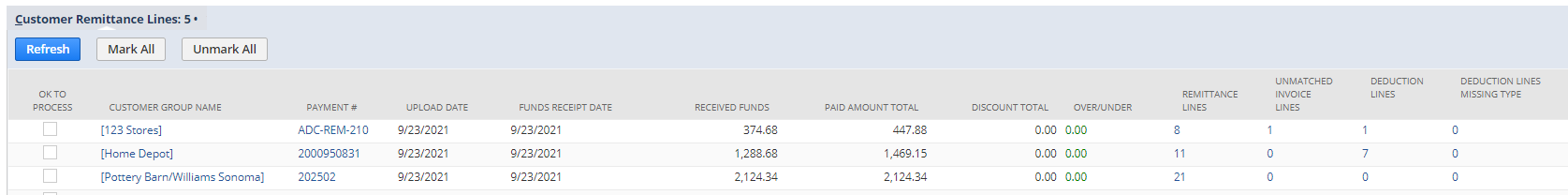

Matching Process

- Once the import is complete, the payment will group by Customer Group Name (parent or customer name with no parent) and the payment #

- If a payment # was not imported, the payment will not show on the Customer Remittance Manager (CRM)

- To correct, go to the Customer Remittances without Payment # saved search

- Add the payment number to the line(s)

- If a payment # was not imported, the payment will not show on the Customer Remittance Manager (CRM)

- A script will match the invoice number to the existing NetSuite invoice record

- For deductions, the script will update the deduction type for the customers will deduction rules setup

Update Missing/Incorrect Information

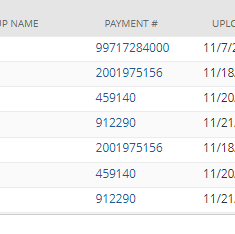

- Drill down using the blue hyperlinks under Payment #

- A new tab will open

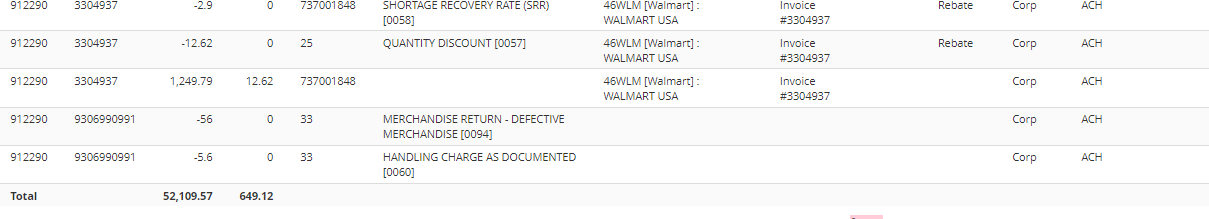

Unmatched Lines

- Scroll down to the bottom of the search

- If the customer is not populated, the line is considered an unmatched line

- All unmatched lines will appear at the bottom

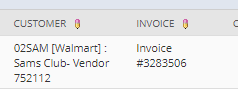

- For positive amounts, complete the following

- If the invoice number is known, select the Invoice

If there is no specific invoice, select the customer and enter the amount in the Overage field (see Overages section below)

If there is no specific invoice, select the customer and enter the amount in the Overage field (see Overages section below)

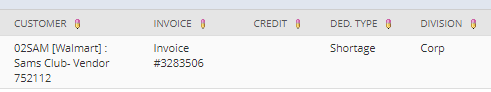

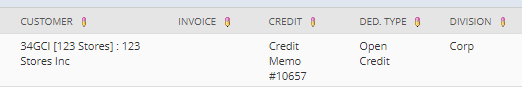

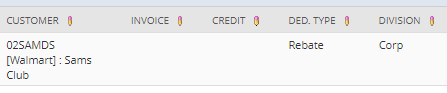

- For negative amounts (aka deductions), select a customer and one of the following options:

- Invoice and Deduction Types Shortage or Direct Deduction

- Credit and Deduction Type Open Credit

- Deduction Type and Division

- For more information regarding the deduction types, refer to Deduction Types

- Optional: For deductions that create credit memos, you can add additional information for the credit memo line. Use field Memo to CM. The system will automatically use the Inv # and Desc (ex. 3100000 | POD/NO MERCHANDISE RECEIVED FOR INVOICE [0025])

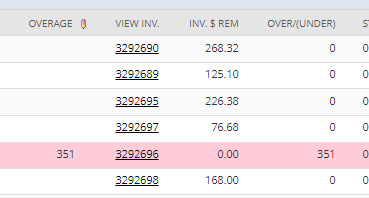

Overages

- If the line is marked as an overage (highlighted in red) and the amount should be unapplied, enter that amount in the Overage field

Payment Method Update

- All imports default to ACH as the method

- If the method is different than ACH, update the Method field

- Select the Method in first row

- Select the correct method in the method drop down

- Hold down SHIFT

- Select the Method in last row

- Hit TAB