What is a Landed Cost Template?

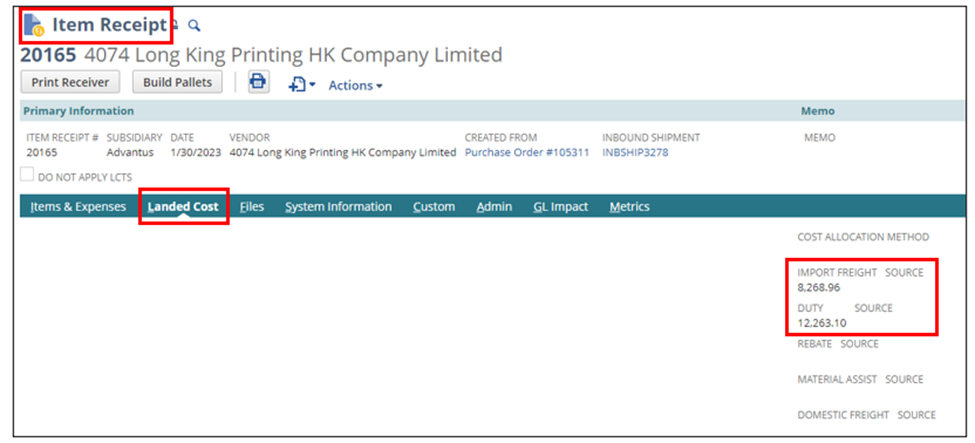

A landed cost template (LCT) is a record that houses an item’s freight and duty components depending on where the item is brought in.

Why is an LCT Important?

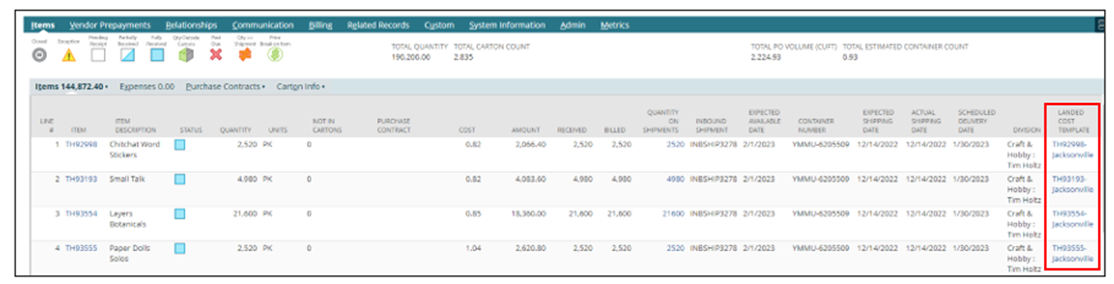

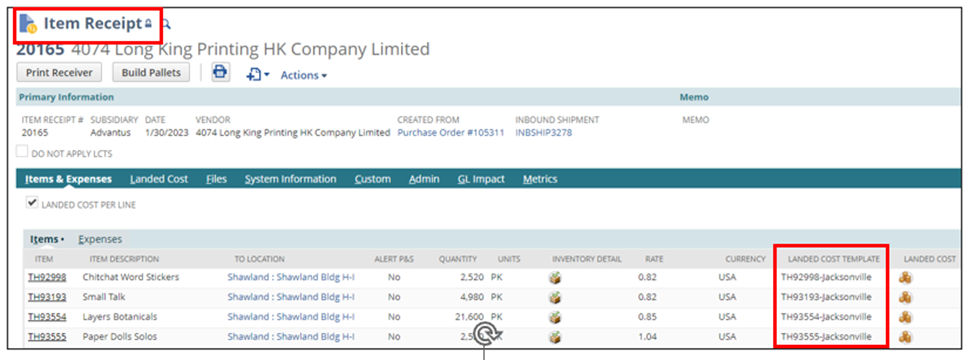

Purchase orders will automatically pull an LCT if the PO header location and LCT location match up. The LCT attached to a PO is the only way freight and Duty get added to the cost of an item when it is received.

How are Initially LCTs Created?

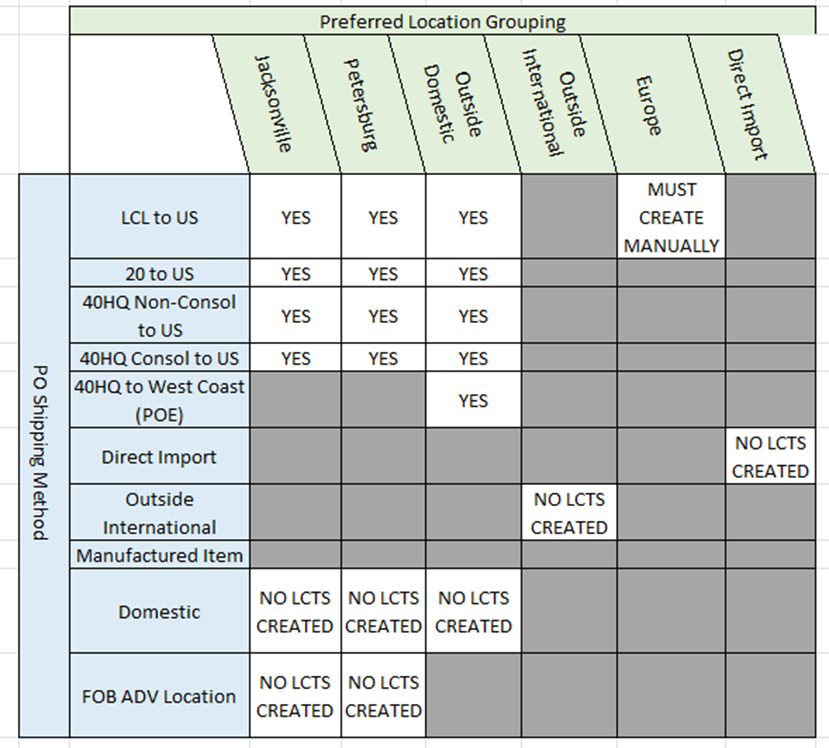

When an item is created, the system automatically creates an LCT based on a combination of the preferred location and PO shipping method.

The chart below shows the various combinations and what will be automatically created.

NOTE: For more information about the preferred location groupings and their locations, see this link: Landed Cost Template Components

NOTE: Certain combinations will never result in LCTs being created, such as Direct Import, Domestic, Manufactured Item, etc., because there is never freight or duty associated with them.

How to Create Additional LCTs

- Using the LCT Component Cheatsheet, confirm which components must be included in the new LCT.

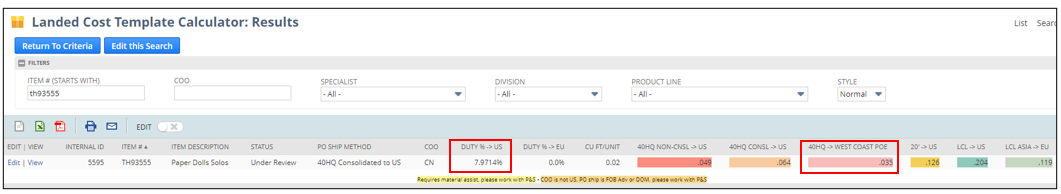

- Using the LCT Template Calculator, find your item using the filter, and it will provide the information needed to fill out the LCT.

- NOTE: Here is a Downloadable LCT Calculator

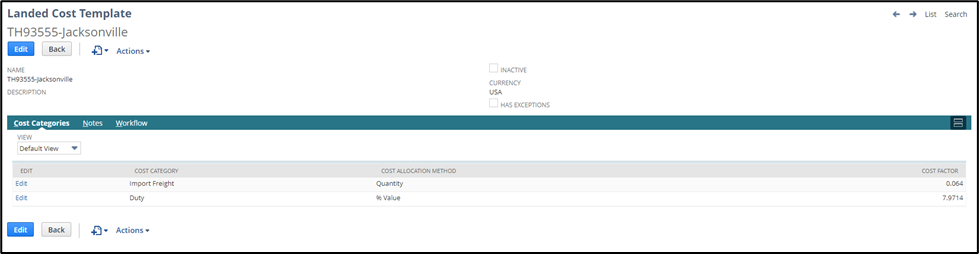

- For this example, we will create an LCT for TH93555 going via a 40HQ to the West Coast.

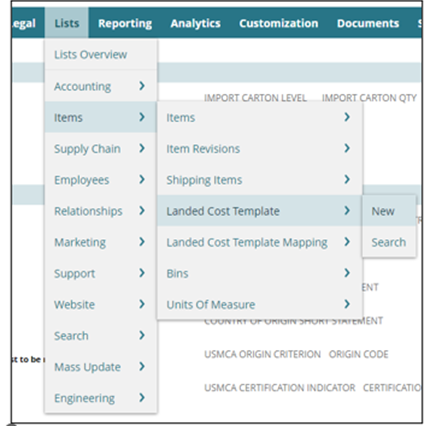

- Click on the path below, and a new record will appear.

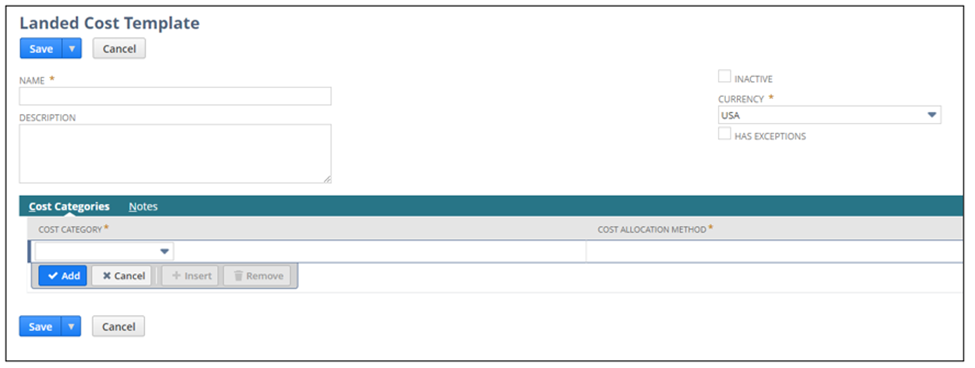

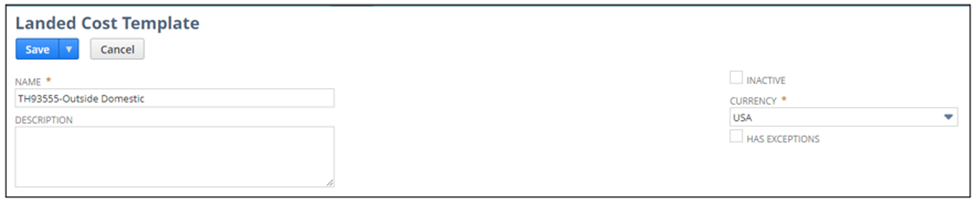

- Enter the item number then – then the costing location designation

- Ex: TH93555-Jacksonville

- Ex: TH93555-Petersburg

- Ex: TH93555-Outside Domestic

- Ex: TH93555-Europe

- Enter any relevant information in the description box if necessary

- Leave the currency alone

- Check this box if your LCT has exceptions like those listed on the cheat sheet.

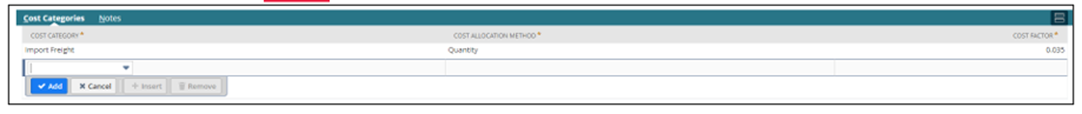

- Enter Import Freight:

- Under cost categories, hit the drop-down and select Import Freight.

- Tab to Cost Allocation Method and select Quantity.

- Tab to Cost Factor and enter the freight cost.

- Click the blue add button.

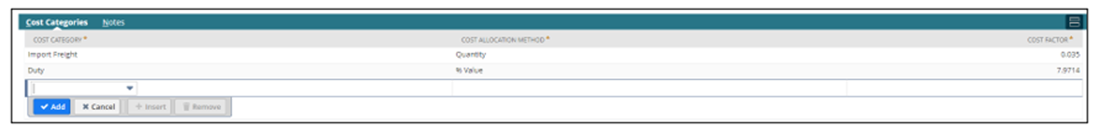

- Enter Import Duty:

- Under cost categories, hit the drop-down and select Duty

- Tab to Cost Allocation Method and select % Value

- Tab to Cost Factor and enter the duty percentage.

- NOTE: DO NOT enter the calculated duty cost based on the percentage.

- Make sure you are using the LCT calculator because it will automatically add the duty percentage and the merchandise/harbor maintenance fee percentages into a single percentage.

- Click the blue add button.

- If applicable, enter other costs, but make sure you speak to a P&S Specialist before adding exception information.

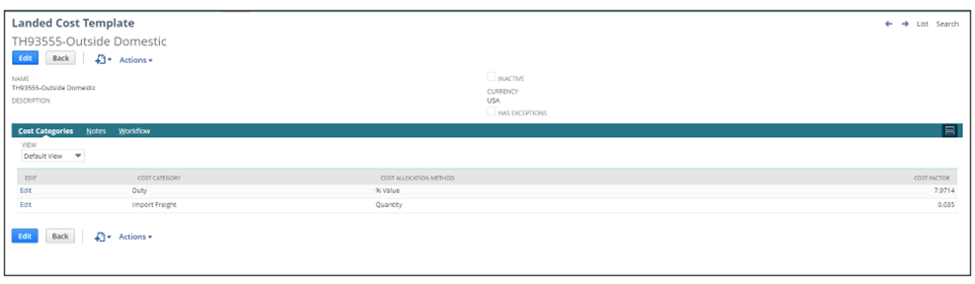

- Hit Save.

- Go to the Item Record

- Select Edit

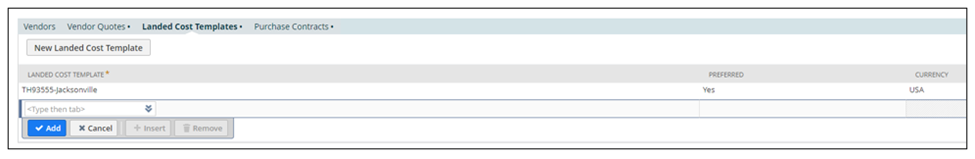

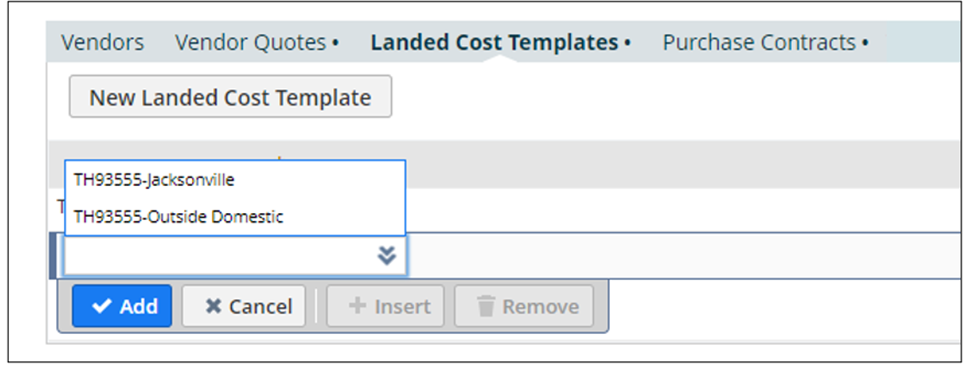

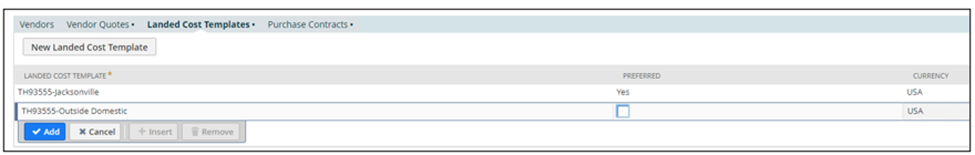

- Go to the Costing subtab, then down to the Landed Cost Templates sublist

- Type the item number and select the LCT template you want to add.

- There can only be one preferred LCT template, so do not check the preferred box.

- Click the blue add button and save the record.

- NOTE: The LCT MUST be assigned to the item record, or a purchase order will not pick it up.