The below processes can be used to authorize a CC, add a new CC, manage CC’s and will also show how to diagnose the reason for a declined credit card.

Authorizing Credit Cards

*Note- The CC must be authorized prior to each release of a sales order.

**When authorizing a credit card, Netsuite will always authorize the full amount of the order, not what is left to ship. If the scenario arises where authorizing the full amount (again) is too much for a customer, we can create a new order with the ‘leftover’ items; which will allow us to authorize the lower amount.

On the sales order, select the Billing subtab

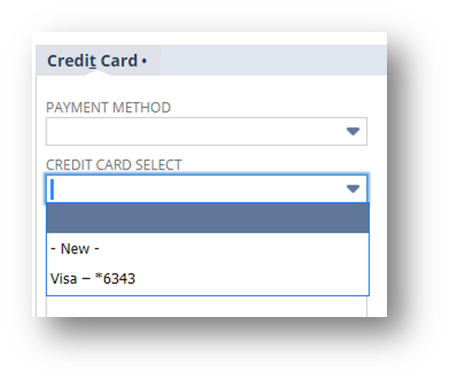

Under credit card, either select an existing card or enter a new card

Existing card

Select the Credit Card Select drop down and choose a card

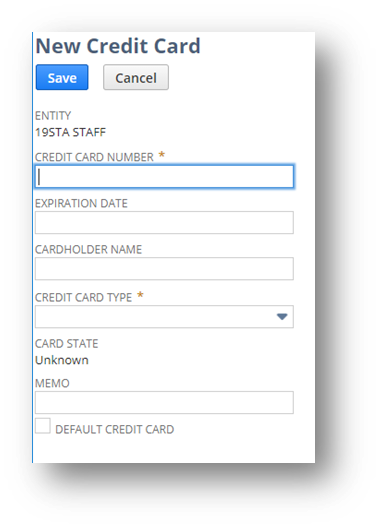

New Card

Select the Credit Card Select drop down and choose New

A popup box will appear to populate the information:

- Credit Card Number

- Expiration Date (Format: MM/YYYY)

- Cardholder Name

- Credit Card Type

- Default Credit Card (Select this checkbox if the customer wants this card to be charged for every order)

- Select Save once complete

- The Card Street and Card Zip code will auto populate based on the Billing address, if this information is not correct, update the fields.

- NOTE: the Card zip code but be correct for the auto to authorize

Once a card has been selected or entered, finish the sales order and hit Save

The card will authorize while the transaction is being saved

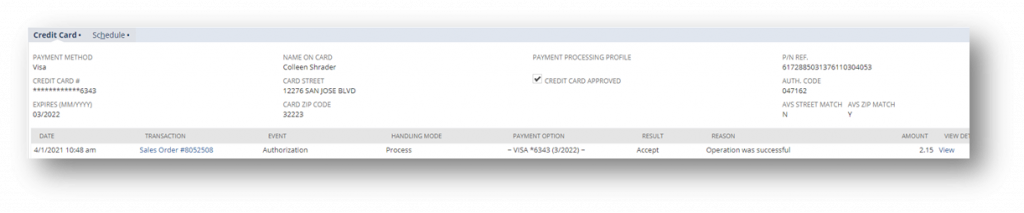

Approval response: If the card is authorized, the transaction will save as normal and the transaction event will appear on the Billing subtab

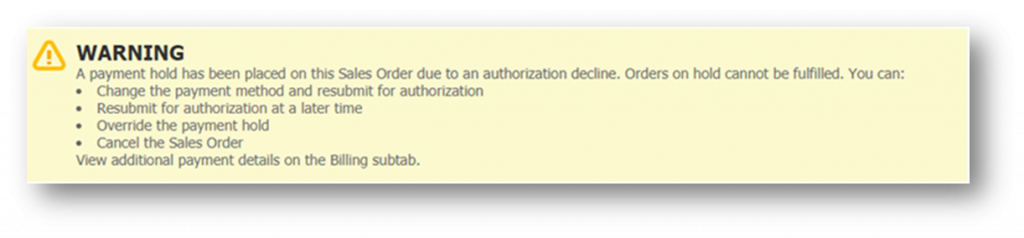

- If the card is not authorized, an error will appear on the top of the sales order

- Research and resolve the issue with the credit card

- To reauthorize the credit card or enter a new card, select Edit on the sales order

- Edit the needed information on the Billing subtab

- Select the Get Authorization checkbox

- Save the sales order

Managing Credit Cards

- The cards for each customer are saved on their customer record on the Financial subtab

- You can remove and add cards and change the default credit card selection in edit mode:

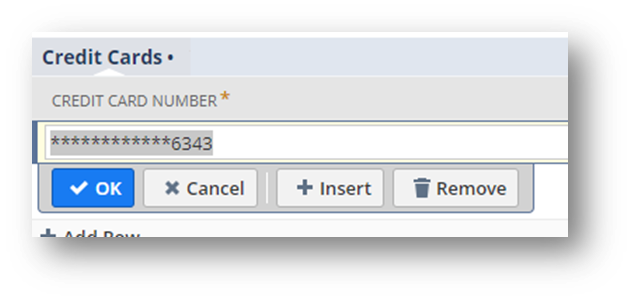

- Remove

- Select the card, hit Remove

- Remove

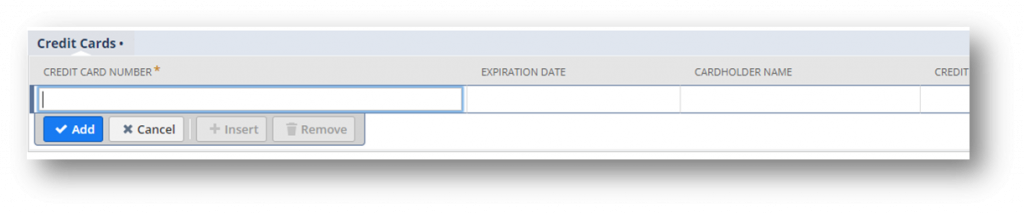

- Add

- Enter the card information directly in the sublist

- Select ADD once complete

- Change the default credit card selection

- Select the card and select the checkbox on the far right

- You must save the customer record to complete the update

Declined Credit Cards

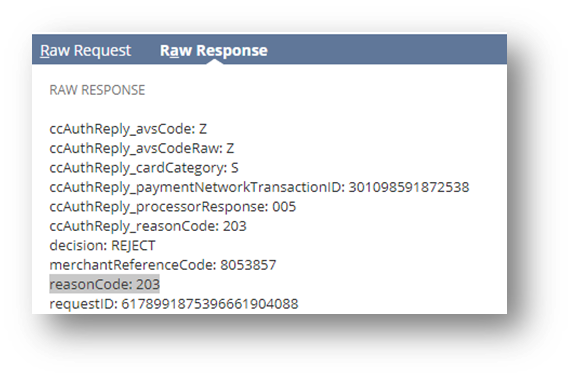

Credit cards can decline for a variety of reasons. The reason code can be found on the payment event.

- Select View hyperlink on the Sales Order (Billing subtab)

- On the popup, scroll down to Raw Response and look for the reason code.

- Use the following guide for the description of the decline reason

| Reason Code | Decline Description |

| 102 | One or more fields in the request contains invalid data. |

| 104 | The merchantReferenceCode sent with this authorization request matches the merchantReferenceCode of another authorization request that you sent in the last 15 minutes. |

| 201 | The issuing bank has questions about the request |

| 202 | Expired card |

| 203 | General decline of the card. No other information provided by the issuing bank. |

| 204 | Insufficient funds in the account. |

| 205 | Stolen or lost card. |

| 207 | Issuing bank unavailable. |

| 208 | Inactive card or card not authorized for card-not-present transactions. |

| 210 | The card has reached the credit limit. |

| 220 | Generic Decline. |

| 221 | The customer matched an entry on the processor’s negative file. |

| 222 | Customer’s account is frozen |

| 231 | Invalid account number |

| 232 | The card type is not accepted by the payment processor. |

| 233 | General decline by the processor. |

| 234 | There is a problem with your CyberSource merchant configuration. |

| 235 | The requested amount exceeds the originally authorized amount. |

| 236 | Processor failure. |

| 237 | The authorization has already been reversed. |

| 238 | The transaction has already been settled. |

| 240 | The card type sent is invalid or does not correlate with the credit card number. |

| 242 | The request ID is invalid. |

| 243 | The transaction has already been settled or reversed. |