Item Conversions will be done per Item Conversion Request. Typically, when stock is low for a particular item.

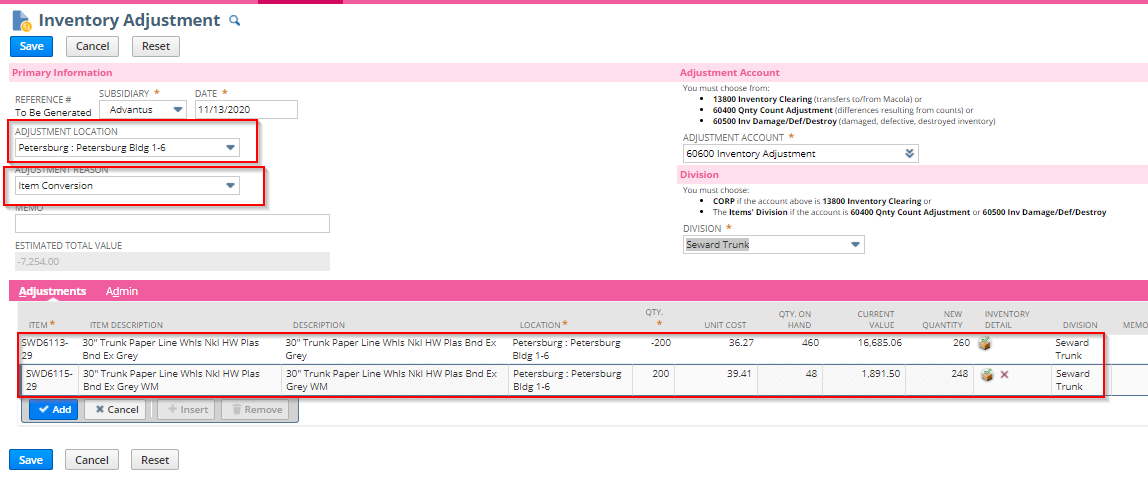

In NetSuite, you will do an Inventory Adjustment.

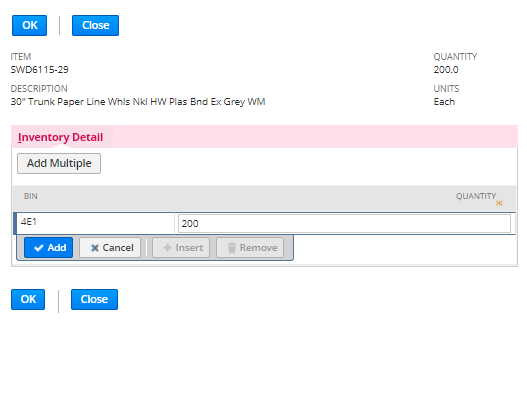

Deduct against the first line item you are converting from and add the second line item you are converting to. Assign the inventory detail bin appropriately.

Ensure that all boxes are pulled and relabeled accordingly (only the outside of the box needs to be relabeled- two carton labels)

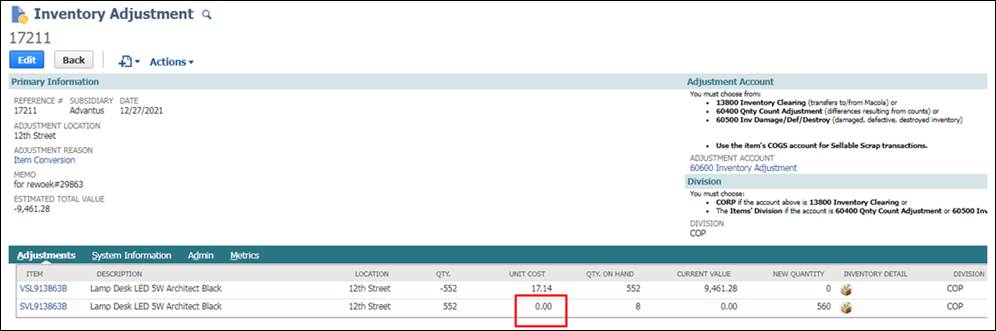

Where we are re-purposing one item for another (item conversion via inventory adjustment), we need to match the cost from the unit we are adjusting out for the unit cost we are adjusting in.

P&S likes to use a “peach pie” training for item conversions – basically what we are doing is choosing to substitute a different peach to make the same pie (finished good). So if we ran out of PEACH-A (unit cost $0.06) and we need to “convert” or use some other peaches, PEACH-B (unit cost $0.07), to finish the pie, the substitute peaches, PEACH-B, still cost us $0.07. The same is true if the substituted peach is cheaper. If we substitute PEACH-C (unit cost $0.05) for PEACH-A (unit cost $0.06), both the ‘out’ and ‘in’ inventory adjustment would use the $0.05 unit cost.

Also, do not round the ‘in’ adjustment’s unit cost. If the ‘out’ unit cost is $0.12345 then the ‘in’ adjustment unit cost needs to be $0.12345, not $0.12.

The OUT inventory adjustment (negative qty) drives the IN adjustment (positive qty).

Always enter the ‘out’ adjustment first so you will know the correct unit cost to use on the ‘in’ adjustment. If you catch yourself entering the wrong unit cost, we can fix the Inventory Adjustment record if it is caught during the same month. DO NOT edit any NS transaction outside of the current month (do not fix something from Dec in Jan).

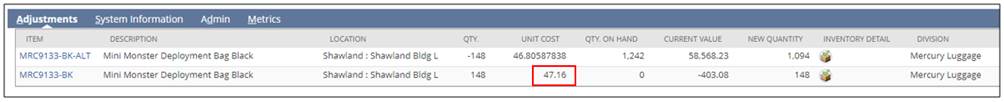

CORRECT:

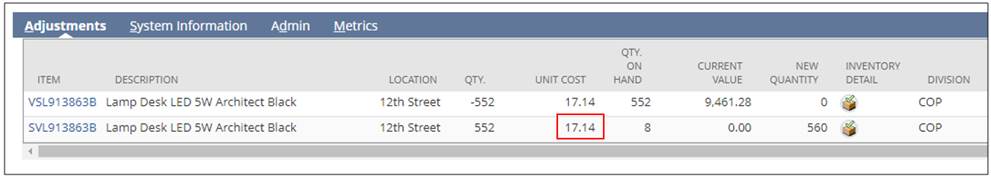

WRONG:

WRONG: